SENIOR TAX OFFICER

WHR Global Consulting

Descrição do Trabalho

Job Title: Senior Tax Officer

Work Arrangement: On-site

Location: Ortigas, Pasig

Employment Type: Full-time

Salary: Php 75,000

About the Role:

We are looking for a detail-oriented and experienced Senior Tax Officer to manage tax compliance, audits, planning, and advisory for the company. You will ensure timely submissions, liaise with tax authorities and consultants, and implement strategies to optimize tax expenses and minimize exposures.

Key Responsibilities:

A. Tax Audits, Litigation, Refunds, and Health Checks

● Complete necessary documentation and reconciliations to support closure of BIR tax audits.

● Prepare replies to Notices of Discrepancies, Preliminary Assessment Notices, and Final Assessment Notices.

● Execute tax health check activities and provide timely and accurate documentation during internal audits.

● Monitor and manage tax issues and assessments from local government units (LGUs) in collaboration with relevant functions.

● Handle tax refund applications and provide required documentation, collaborating with external tax consultants.

● Serve as liaison to the BIR and external consultants.

B. Tax Planning

● Assist in identifying opportunities to maximize tax incentives, credits, and refunds.

● Develop strategies to reduce tax expenses across business operations and transactions, including tax treaty relief applications.

● Implement controls to mitigate tax exposures identified by tax authorities during audits.

● Prepare monthly/quarterly income and expense analyses to determine optimal deductions and tax due.

● Conduct annual analysis of taxable income for potential carry-over of excess CWT or CWT refunds.

● Update the company tax manual and ensure adherence to the transfer pricing policy.

C. Tax Advisory

● Handle queries on tax implications of business transactions such as acquisitions, spin-offs, and transfer pricing.

● Coordinate with the Tax Compliance team on new issuances and their effects on company tax status.

Qualifications:

● Certified Public Accountant (CPA).

● Experience in accounting systems (SAP, Netsuite) and statutory tax reporting.

● Up-to-date knowledge of BIR issuances, rulings, and tax regulations.

● Advanced Excel skills, detail-oriented, and able to work under pressure.

● Willing to be assigned in Ortigas, Pasig City.

Why Join Us:

● Work in a fast-paced and professional finance environment.

● Opportunity to lead and optimize tax compliance, planning, and advisory initiatives.

● Collaborative culture with growth and learning opportunities.

Candidates with attached CV and relevant experience will be considered for a phone interview.

Mikaela Payong

Recruitment AssociateWHR Global Consulting

Responder Hoje 4 Vezes

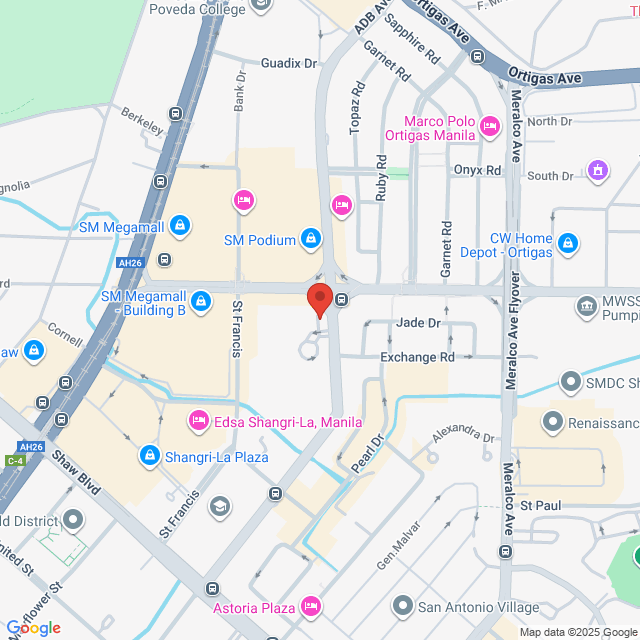

Local de trabalho

Ortigas Center. Ortigas Center, Pasig, Metro Manila, Philippines

Postado em 14 November 2025

Tax Specialist

WHR Global Consulting

WHR Global ConsultingR$5.6-6.6K[Mensual]

No - Manila5-10 anos ExpBacharelTempo Inteiro

Angel PelingonHR Officer

Tax Specialist

Perez, Sese, Villa & Co.

Perez, Sese, Villa & Co.R$2.8-3.3K[Mensual]

No - Manila1-3 Anos ExpBacharelTempo Inteiro

Celine FernandezHR Manager

Tax Specialist - License

Super 8 Retail Systems, Inc.

Super 8 Retail Systems, Inc.R$1.9-2.4K[Mensual]

No - Manila<1 ano de experiênciaDiplomaTempo Inteiro

Jonathan AbundoHR Assistant - Recruitment

Tax Support Specialist (Negotiable Salary)

J-K Network Services

J-K Network ServicesR$3.3-3.8K[Mensual]

No - Taguig1-3 Anos ExpBacharelTempo Inteiro

J-K Recruiter_ExecRecruiter

Tax Specialist

Moulton RB Corp.

Moulton RB Corp.R$1.9-3.8K[Mensual]

No - Cidade do Quezon1-3 Anos ExpBacharelTempo Inteiro

HR TinHR Manager

Sign In to Chat with Boss

Bossjob Safety Reminder

If the position requires you to work overseas, please be vigilant and beware of fraud.

If you encounter an employer who has the following actions during your job search, please report it immediately

- withholds your ID,

- requires you to provide a guarantee or collects property,

- forces you to invest or raise funds,

- collects illicit benefits,

- or other illegal situations.